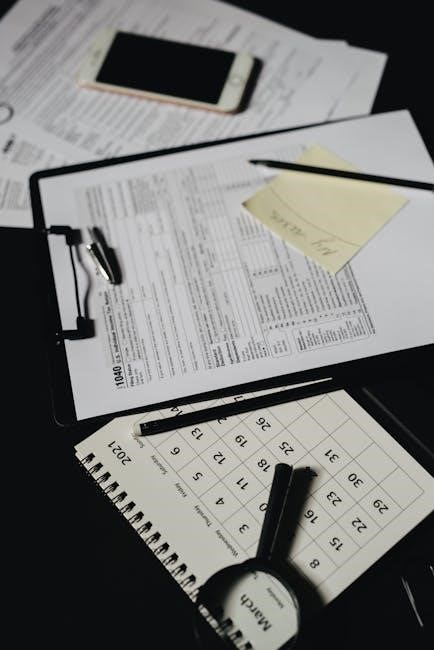

Form 990 Schedule C is a supplementary form used by certain nonprofit organizations to report political campaign and lobbying activities to the IRS․

It ensures transparency and compliance with tax-exempt status requirements, providing detailed disclosures about direct and indirect political or lobbying efforts․

1․1 Overview of Schedule C

Schedule C is a supplementary form accompanying Form 990 and 990-EZ, used by tax-exempt organizations to report political campaign and lobbying activities․

It requires detailed disclosures about direct and indirect efforts, ensuring transparency and compliance with IRS regulations․

Organizations eligible to file include Section 501(c) and 527 entities, which must provide comprehensive information to maintain their tax-exempt status․

The schedule is divided into parts, focusing on political campaigns and lobbying expenditures, ensuring accurate and complete reporting․

Completion is mandatory for organizations answering “Yes” to specific questions in Form 990 or 990-EZ, ensuring adherence to IRS guidelines and public disclosure requirements․

1․2 Purpose of Schedule C

The primary purpose of Schedule C is to ensure transparency and compliance by requiring tax-exempt organizations to disclose their political campaign and lobbying activities to the IRS․

It helps maintain accountability and verifies that organizations are adhering to the regulations governing their tax-exempt status․

By reporting these activities, organizations demonstrate their commitment to ethical practices and public trust․

The schedule also assists the IRS in monitoring compliance with specific tax laws related to political and lobbying expenditures․

Accurate completion of Schedule C is crucial for maintaining tax-exempt status and avoiding penalties․

Who Must File Schedule C

Organizations filing Form 990 or 990-EZ, including section 501(c) and 527 entities, must file Schedule C if they engage in political campaigns or lobbying activities․

2․1 Eligible Organizations

Section 501(c) organizations and section 527 political organizations are required to file Schedule C if they engage in political campaigns or lobbying activities․ This includes charities, unions, and trade associations․ Organizations filing Form 990 or 990-EZ must complete Schedule C if they answer “Yes” to questions about political campaigns, lobbying, or membership dues on lines 3, 4, or 5 of Form 990, or lines 46 or 47 of Form 990-EZ․ This ensures compliance with IRS transparency requirements for tax-exempt entities involved in such activities․

2․2 Requirements for Filing

Organizations must file Schedule C if they answer “Yes” to questions about political campaigns, lobbying, or membership dues on Form 990 (lines 3, 4, or 5) or Form 990-EZ (lines 46 or 47)․ This includes reporting political campaign expenditures, lobbying activities, and certain membership dues․ The IRS mandates detailed disclosure to ensure transparency and compliance with tax-exempt status requirements․ Accurate completion is critical to avoid penalties and maintain exempt status․ Failure to report correctly may result in IRS scrutiny or loss of tax-exempt privileges․ Ensure all applicable sections are filled out thoroughly, adhering to IRS guidelines for proper compliance and reporting accuracy․

Structure of Schedule C

Schedule C is divided into two parts: Part I for political campaign activities and Part II for lobbying activities, with additional sections for other information․

3․1 Part I: Political Campaign Activities

Part I of Schedule C focuses on reporting political campaign activities, ensuring transparency in nonprofit engagement with political processes․

Organizations must disclose expenditures related to political campaigns, including contributions to candidates, political parties, or voter registration drives, ensuring compliance with IRS regulations․

3․2 Part II: Lobbying Activities

Part II of Schedule C is dedicated to reporting lobbying activities, ensuring nonprofits disclose efforts to influence legislation or government actions․

Organizations must detail lobbying expenditures, methods used, and specific issues addressed, providing clarity on their advocacy efforts and ensuring compliance with IRS guidelines․

Instructions for Completing Schedule C

The IRS provides detailed instructions for completing Schedule C, covering both political campaign and lobbying activities reporting․

Organizations must follow these guidelines to ensure accurate and compliant disclosure of their activities․

4․1 Step-by-Step Guide

To complete Schedule C, organizations must follow a structured approach:

- Review eligibility: Determine if the organization is required to file based on its type and activities․

- Complete Part I: Report political campaign activities, including expenditures and contributions․

- Complete Part II: Disclose lobbying activities, detailing expenditures and issues lobbied․

- Attach required documents: Include statements explaining the nature of activities․

- Ensure accuracy: Verify all figures and disclosures align with IRS guidelines․

Following these steps ensures compliance with IRS requirements for transparent reporting․

4․2 Required Disclosures

Organizations must disclose details about their political campaign and lobbying activities in Schedule C․ This includes:

- Political expenditures: Total amounts spent on campaigns and contributions to political committees․

- Lobbying activities: Detailed descriptions of issues lobbied, including legislative bodies involved․

- Indirect activities: Support for grassroots lobbying or communications to influence public opinion․

- Election-related disclosures: Statements confirming compliance with election laws․

- Specific issues lobbied: Clear identification of legislative or regulatory matters․

Accurate and complete disclosures are essential to maintain compliance and ensure transparency․

Reporting Requirements

Organizations must report all lobbying and political campaign expenditures, ensuring transparency and compliance with IRS regulations through detailed disclosures․

5․1 Lobbying Expenditures

Organizations must report all lobbying expenditures on Schedule C, providing detailed disclosures about direct and indirect lobbying activities․ This includes expenses related to influencing legislation or governmental decisions․ Section 501(c)(3) organizations must complete Part II of Schedule C if they engaged in lobbying activities or elected under Section 501(h)․ Accurate reporting is crucial to maintain tax-exempt status and comply with IRS regulations․ Expenses must be categorized and summarized, ensuring transparency and adherence to reporting thresholds․ Proper documentation and compliance with disclosure requirements are essential to avoid penalties and ensure public trust․ Always refer to the IRS instructions for specific guidelines on reporting lobbying expenditures accurately․

5․2 Political Campaign Expenditures

Schedule C requires organizations to report all political campaign expenditures, ensuring transparency in their involvement in political activities․ This includes direct and indirect expenses related to campaigns, such as contributions to candidates or political parties․ Organizations must disclose the purpose and amount of each expenditure, adhering to IRS guidelines․ Section 501(c)(3) organizations must report these activities to maintain tax-exempt status․ Accurate and detailed reporting is essential to comply with regulations and avoid penalties․ The IRS mandates strict adherence to disclosure requirements to ensure public trust and accountability․ Refer to the official instructions for specific guidance on reporting political campaign expenditures correctly․

Compliance and Accuracy

Compliance with IRS guidelines is crucial for accurate reporting on Schedule C․ Organizations must ensure all disclosures are truthful and complete to maintain tax-exempt status and public trust․

6․1 Importance of Accurate Reporting

Accurate reporting on Form 990 Schedule C is essential for maintaining tax-exempt status and public trust․ Inaccuracies can lead to penalties, audits, or loss of exemption․

Organizations must ensure all disclosures about political campaign and lobbying activities are truthful and complete, adhering to IRS guidelines to avoid legal and reputational risks․

6․2 Common Mistakes to Avoid

Common errors in Form 990 Schedule C include incomplete disclosures, misclassification of activities, and incorrect calculations of lobbying expenses․

Organizations should ensure they accurately distinguish between political campaign and lobbying activities, avoiding over or underreporting․

Failing to complete required sections or not adhering to IRS definitions can lead to compliance issues․

Additional Resources

Visit the official IRS website at irs․gov for comprehensive guidelines, instructions, and resources to assist in completing Form 990 Schedule C accurately․

7․1 IRS Guidelines

The IRS provides detailed guidelines for Form 990 Schedule C on their official website, ensuring clarity on reporting political and lobbying activities․

These guidelines outline specific requirements, definitions, and examples to help organizations accurately complete the form and maintain compliance with tax-exempt status regulations․

Visit irs․gov to access the latest updates, instructions, and resources for Form 990 Schedule C, ensuring accurate and timely filing․

7․2 Helpful Tools and References

Several tools and resources are available to assist with completing Form 990 Schedule C, including the IRS website, which offers detailed instructions and downloadable forms․

Additional resources include tax software, webinars, and guides from nonprofit associations, providing step-by-step assistance and examples to ensure accurate reporting of political and lobbying activities․

These tools help organizations navigate complex requirements, ensuring compliance and maintaining their tax-exempt status effectively․